Pocket Bank

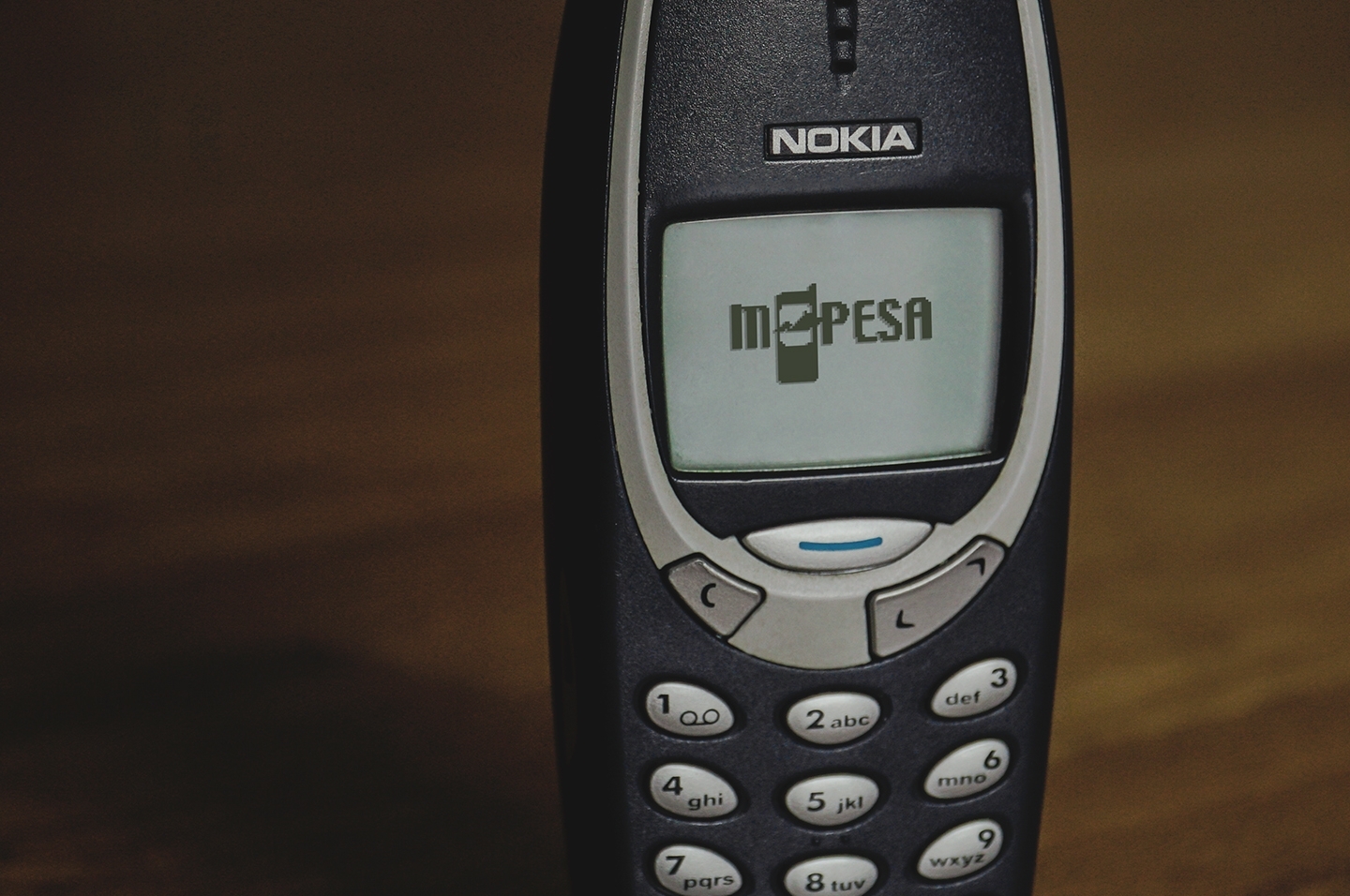

Mobile banking is a relatively recent phenomenon in the western world. Only in the last few years has the wallet become expendable as our cards sit inside our Apple Wallet or Google Pay. Kenya’s mPesa allowed anyone to turn their mobile phone into a pocket bank…back in 2007.

Mobile banking is a relatively recent phenomenon in the western world. Only in the last few years has the leather wallet become expendable as our cards sit inside our Apple Wallet or Google Pay; two companies we see as leaders of innovation. That being said, they are standing on the shoulders of Kenyan software engineers a decade earlier.

In 2007, Kenya launched their mPesa service. The mobile-only banking service, launched by Vodafone allowed anyone to turn their mobile phone into a pocket bank. Users could deposit, withdraw, transact, take out loans and save through SMS based transfers. Why is this significant beyond just a tech history lesson?

It sounds like an insecure and clunky product but it may have been one of the greatest economic enablers created. Let’s start from square one. Access to banking is incredibly important for development and poverty alleviation.

Research has estimated that mPesa helped pull 2% of Kenyan households out of poverty. Moreover, female-led households saw a far greater positive impact on consumption. Almost 200,000 females were able to pick a business or retail occupation instead of farming.

The switch from cash to mobile-based banking is largely responsible for this. Non-cash banking allows people to earn interest on savings and is way more secure than paper cash. Having a safe place to store wealth allowed citizens to plan further ahead with their spending.

On top of that, remittances became so much easier. Instead of paper money being sent across the country to families, funds could be sent in seconds spreading wealth across households. In the event of a shock, like a flood or a tractor breaking down, communities can send money to alleviate the strain. On a community-wide level, this decreased concentration of risk on the individual, allows citizens to take more risks like starting businesses or buying assets like new farm equipment.