Slipstream

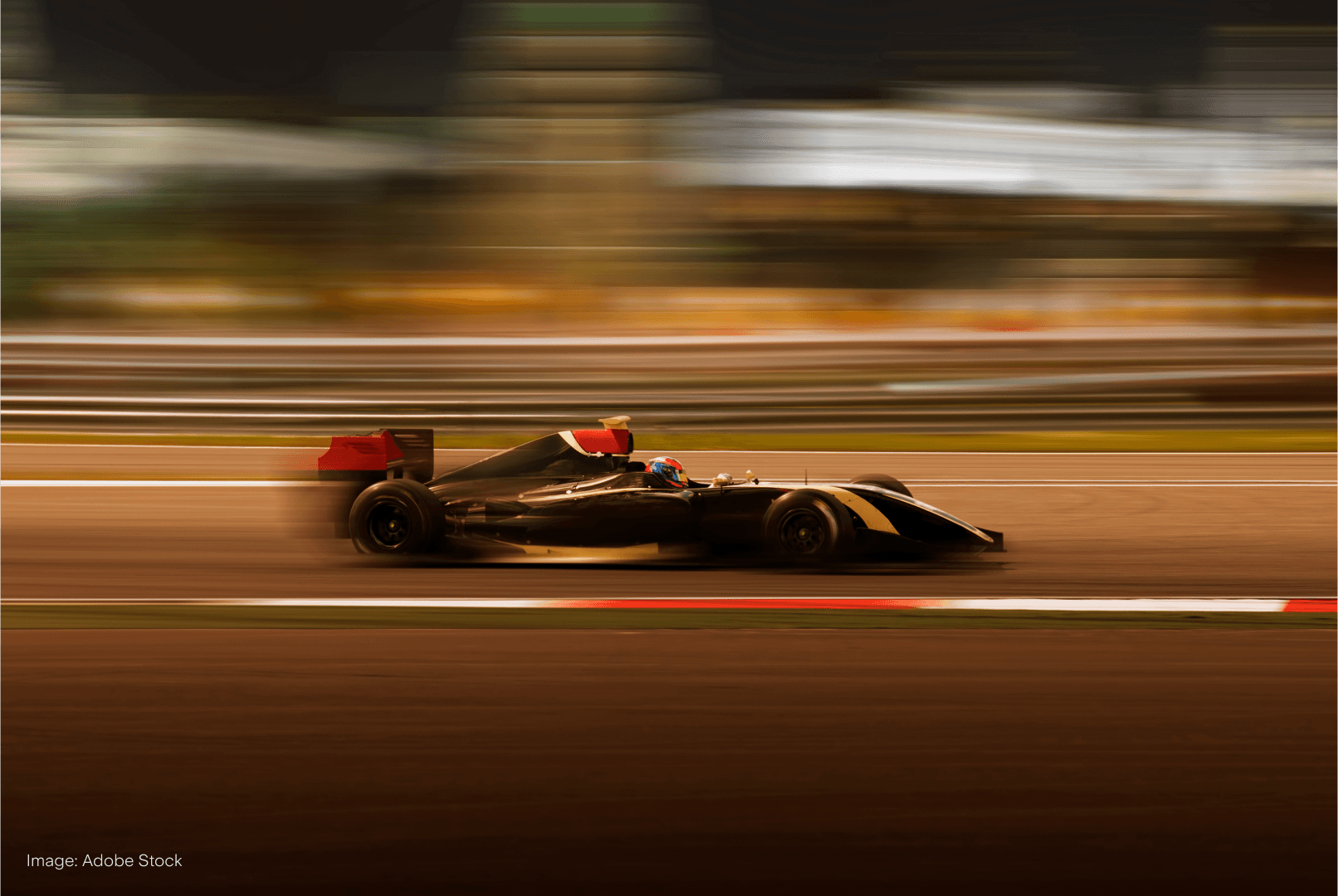

Formula 1 is back. As the world’s fastest racing cars vie for pole position, so do Wall Street’s top growth stocks.

The Australian Grand Prix kicks off the 2025 F1 season next week. A record number of fans are expected, topping the 452,055 in attendance across last year’s race weekend. Whether they’re longtime enthusiasts or newer fans brought in by Drive to Survive – the ingenious partnership between Netflix ($NFLX) and Formula One Group ($FWONA) – they all consider F1 the pinnacle of motorsport.

And that’s because a lot goes into R&D and elite drivers testing the limits of each track with high-performance cars. It’s an expensive affair, but at the end of the day, it's high risk, high reward. And growth stocks aren’t very different.

They look expensive, with P/E ratios that are twice or thrice the industry standard. But for these firms, their rate of revenue and earnings growth is also far from average, outpacing that of some peers each financial reporting period.

Perhaps no company encapsulates this better than Nvidia ($NVDA). GPU innovation and AI dominance set it on the fastest track to the $3t milestone. It took just 96 days for its market cap to get from two to three trillion dollars, while Microsoft ($MSFT) took 649 days and Apple ($AAPL), 718 days.

Earnings last week showed that it’s still blowing past expectations, with Q4 revenue up 78% YoY and CEO Jensen Huang saying the company needs to continue scaling because of high demand for its Blackwell chips. Shareholders were relieved… Until Trump confirmed tariffs on Canada and Mexico this week, sending $NVDA down to September 2024 levels.

Bumps aside, Nvidia’s era of dominance is a lot like the eight consecutive constructors titles Mercedes won between 2014 and 2021, until Max Verstappen – a relatively new face at the time – kick-started Red Bull’s time in the sun. Last year, there was a new name dominating Wall Street’s list of top performers: tech firm AppLovin ($APP). And while this firm isn't trying to challenge Nvidia’s business, it's quickly winning a place in investor portfolios.

AppLovin’s share price is up over 600% in a year, driven by impressive Q4 results that show a 44% YoY increase in revenue to US$1.37b. Not unlike F1 strategies, its growth was the ‘result of sharp, precise execution across multiple fronts,’ says W Media Research’s chief analyst Karsten Weide. Specifically, a strategic pivot away from mobile apps and into its AI-powered ad platform AXON.

Of course, the faster you’re going, the harder the crash feels. And while F1 cars might see better performance and stability with more downforce, the same can’t be said for certain growth stocks: downward pressure on the markets takes them down too. Supermarket chain Sprouts Farmers Market ($SFM) and restaurant firm Cava Group ($CAVA) clocked triple-digit gains last year, but are currently proving just how quickly market sentiment can turn negative amid a broader selloff.

Much like an F1 team fine-tunes their car ahead of each race week, investors too can benefit from recalibrating portfolios every now and then. In a week when market participants are bracing for the impacts of Trump tariffs and risk assets are tracking lower, now is as good a time as any to reassess allocation strategy.