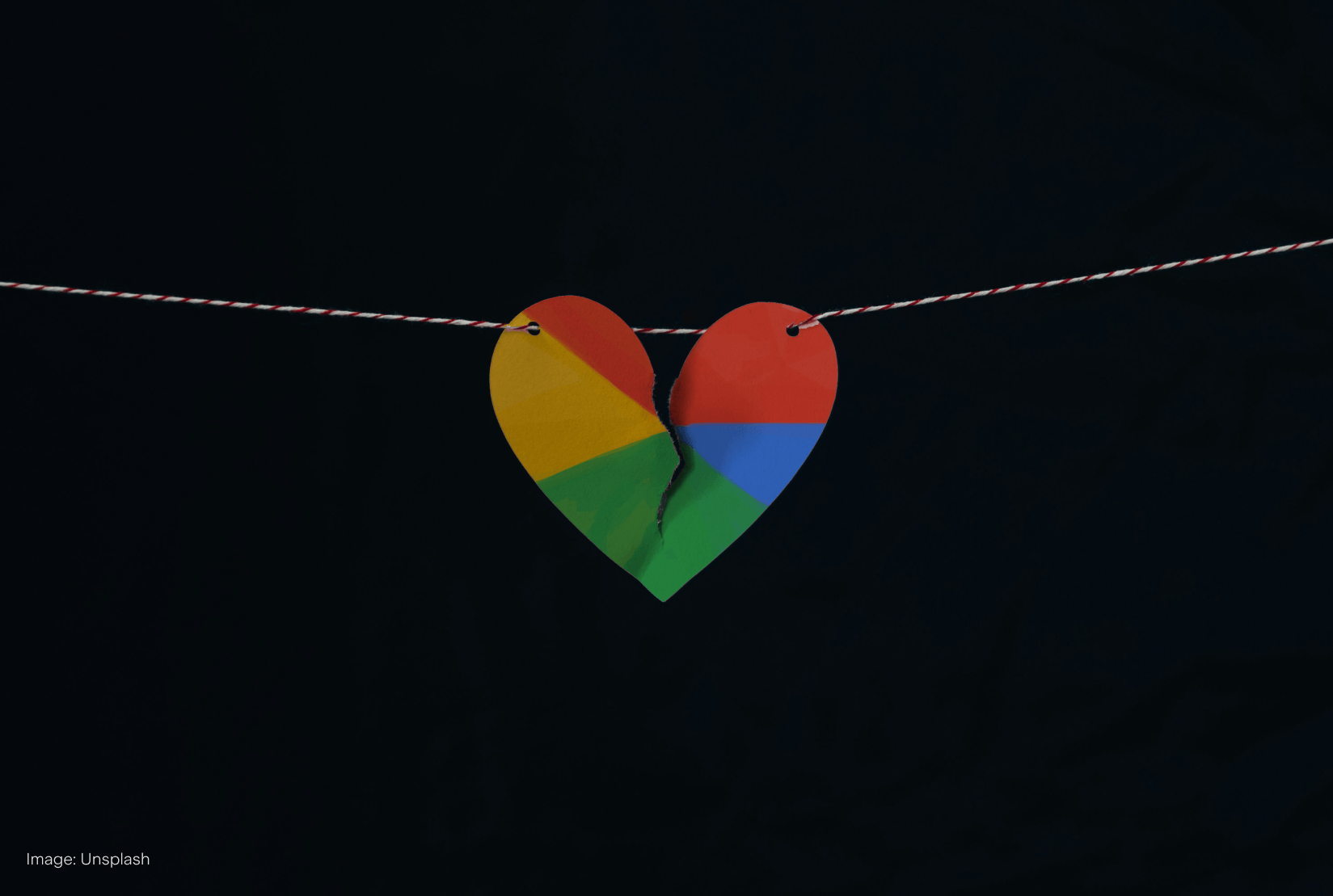

Breakup

The DOJ wants to break up Google. But this could impact the bottom lines of hundreds of other companies and set a worrying precedent for big tech in the antitrust crosshairs.

Alphabet ($GOOG) controls 90% of the search engine market. In 2020, the U.S. Department of Justice filed an antitrust lawsuit against the tech giant, alleging illegal dominance in online search. It was probably a bit too late to clamp down on Google for behaviour two decades in the making, but hey, better late than never?

Prosecutors centred their case around Google’s contracts with companies like Apple ($AAPL) to make Google the default search engine on Safari. The lawsuit later expanded to include broader aspects of Google's business, including its use of Chrome, Android and AI technologies.

Google’s main defence was that its search engine’s popularity was a product of superior quality and user preference. Whether for that reason or corporate manipulation, ‘google’ has been a verb since 2006 and part of nearly everyone’s vocabulary.

Either way, U.S. District Judge Amit Mehta ruled that Google had illegally abused its search monopoly in August. Last week, the DOJ hinted at potentially breaking up Google’s business as one of the proposed ‘behavioural and structural remedies.’

‘Splitting off Chrome or Android would break them — and many other things,’ wrote Google’s Vice President of Regulatory Affairs, Lee-Anne Mulholland. She also suggested that restrictions on how it promotes its search engine would reduce revenue for companies like Mozilla and impact Android smartphone makers, potentially raising the cost of devices.

‘Because Android and Chrome are used by so many developers and device makers across different industries – from cars to fitness devices to TVs to laptops to apps and more – changes could impact many businesses and the people who use their services,’ said Mullholland.

She makes a valid point. Even the businesses that don’t rely on Android software build their infrastructure around Google’s algorithms. At the end of the day, a Google breakup could have ripple effects across industries.

It would also be the most significant antitrust action in the U.S. since AT&T's ($T) dismantling in 1984 and could set a precedent for future antitrust cases against big tech companies. That’s a big deal considering 43% of the S&P 500 (by market cap) is currently under antitrust scrutiny and/or investigation, according to research from Bank of America.

Reports that Nvidia ($NVDA) was facing an antitrust probe sent the stock down nearly 10% on 4 September (although Nvidia claims it never received a subpoena from the DOJ). The FTC’s case against Amazon ($AMZN) for its alleged ‘anti-competitive tactics’ is set to move forward after the company failed to dismiss the lawsuit.

It’s a similar story for Meta ($META): the company failed to dismiss an FTC case alleging that its acquisition of Instagram and WhatsApp led to a social media monopoly. Visa ($V) has been accused of illegally monopolising the debit card market, using its power to extract higher fees from consumers. And even Apple could face its day of reckoning as the DOJ builds an antitrust case against the tech giant’s locked-down iPhone ecosystem.

What happens with Google might dissuade other firms from expanding via takeovers – gobbling up the competition is a major red flag for antitrust regulators. That leaves them with one option: organic growth. Strong balance sheets, positive free cash flow and (yes) harnessing AI will be the need of the hour.