Under the Spotlight: Virgin Galactic (SPCE)

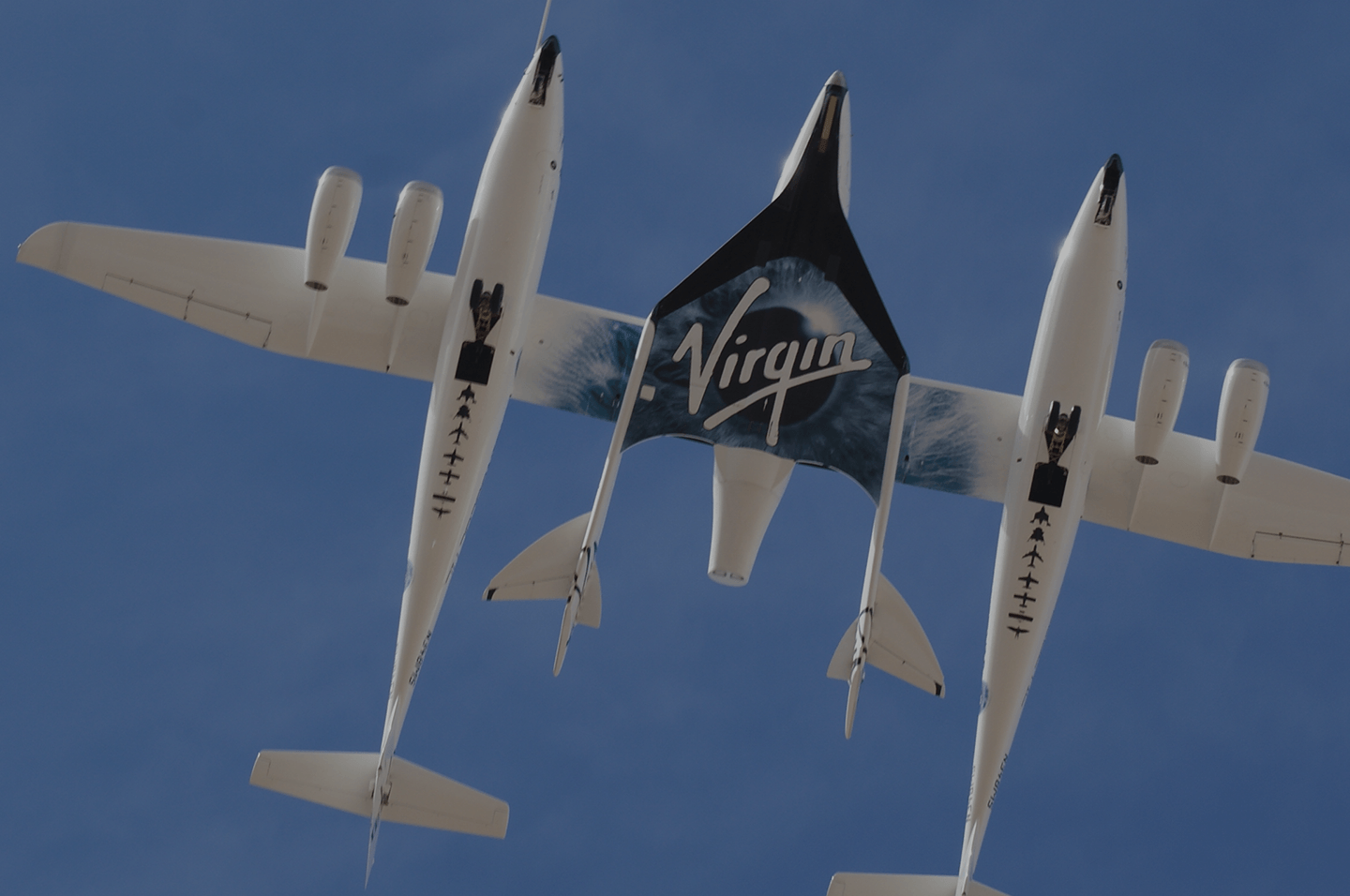

We’re in the midst of a new-age Space Race. What was an outlet for trans-national tension is now a passage for billionaires to compete over intergalactic tourism. Headlining the show is Virgin Galactic, Richard Branson’s US$2b project.

You can have one of the most stamped passports in the world, traversed the seven seas and scaled the highest mountains… but there’s a destination alluding to even the most seasoned traveller: space.

That is, until recently. During the 2000s, a number of companies emerged promising space tourism. Of the three main exponents of the race (Blue Origin, SpaceX and Virgin Galactic), Virgin Galactic is the youngest of the group. Founded in 2004 by Richard Branson, the billionaire behind Virgin music and airlines, the company is perhaps the only one whose founder already has experience in aerospace and tourism. The other competitors were founded respectively by Jeff Bezos and Elon Musk.

Turbulent takeoff

In July 2021 Virgin Galactic won the space race of private companies by sending Branson into the unknown, officially the first tourist to break through the stratosphere. Obviously reaching this point, a whole 17 years after being founded, indicates how challenging building a rocket is.

Originally, Virgin Galactic’s first manned flight was supposed to take place in 2011. However, explosions, changes in the fuel used and even aircraft redesign were some of the obstacles that prevented commercial flights from being carried out by the company until now.

With the success of the flight carried out in July 2021, broadcasted live around the world, the company hopes to have left these difficulties behind. But Virgin still has to cross another frontier: that of profitability.

Stratospheric costs

When dealing with space tourism, it is important to make it clear that we are talking about a luxury market focused only on multi-millionaires. If you think a Super Bowl ticket or cruise to Antarctica is expensive, Seat 1A on Virgin Galactic ships are at a whole new level. At US$450k per ticket, 750 available seats have already been sold since August 2021.

Of course, positive margins on space travel are still non-existent. Sending a tourist to space is an expensive game.

In the fourth quarter of 2021 alone, Virgin Galactic’s registered a US$81m loss taking their total losses past US$1b since inception. While the company is trading at an almost infinite revenue multiple, and will until they start launching flights, it has a healthy balance sheet. The company is well-capitalised to face the challenge of seeking profitability. Virgin has almost $1 billion in cash on the books. When analysing the company’s price/book ratio, we arrive at 2.70, right in line with the airline average, which is 2.67.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.