Under the Spotlight Wall St: HP Inc (HPQ)

For more than 80 years, HP has been one of the key players in the office space. However, the computing-hardware giant’s crown has lost its shine in recent times. Can it reclaim its throne? Let’s put it Under the Spotlight.

.jpg&w=3840&q=100)

Established in a small garage in Palo Alto, California in 1939, HP Inc ($HPQ) (formerly known as Hewlett-Packard) is arguably the founding father of Silicon Valley’s tech industry. College friends Bill Hewlett and David Packard started with only US$538 to bootstrap the company (roughly US$12,000 adjusted for inflation today) and set out to create innovative electronic test equipment. Their first product was the Model 200A Audio Oscillator, a critical tool for sound engineers that became an instant success due to its reliability and affordability.

One of the company’s earliest famous customers was Walt Disney Studios ($DIS). At the time, the entertainment giant was recording its now celebrated animated film Fantasia and needed eight oscillators to test its sound equipment. Plans to expand the business came to a brief halt when World War Two escalated and HP had to repurpose its operations to produce radar equipment. But after the war, HP continued to grow, with its biggest breakthrough coming in the 1960s.

Computing successes

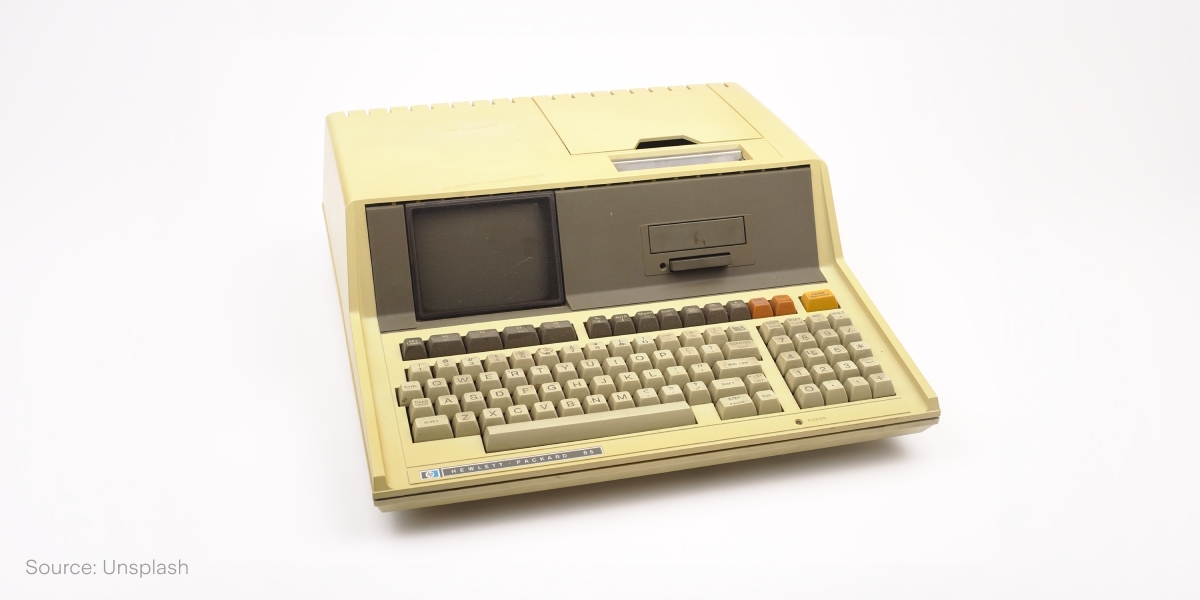

In 1966, HP released its first computer. With tens of thousands of sales, the HP 2100 was a game changer for the company and helped cement its status as a key player in the still nascent computer industry. The launch of the 9100A in 1968 further increased HPs presence in computing-hardware and some considered this model to be the world’s first personal computer (PC).

By the 1970s, HP had established itself as the fourth-largest computer manufacturer. But the company did not rest on its laurels, becoming more active in the consumer electronics market. The success of the HP-35, the world’s first scientific pocket calculator, continued to drive the business forward.

The 1980s witnessed HP's foray into inkjet printing technology, starting with the introduction of the HP ThinkJet printer. This groundbreaking innovation brought affordable and high-quality printing to households and small businesses. The company continued to expand its printer line, launching the first LaserJet printer in 1984. This product series became an industry standard for laser printing, solidifying HP's position as a leader in the market.

HP further expanded its product range and entered new markets in the 1990s. The company diversified its offerings to include consumer-oriented personal computers, laptops and printers. HP's Pavilion series of personal computers gained popularity with the public, cementing its position in computer hardware manufacturing. The decade also saw the first HP spin-off, the healthcare equipment manufacturer Agilent Technologies ($A), whose 1999 IPO came at a valuation of US$8b. At the time, it was the largest IPO in Silicon Valley history and allowed HP to streamline its focus onto the consumer electronics industry.

Merging issues

Despite the Agilent spin-off, HP was still on the lookout for potential mergers and acquisitions with companies that shared synergies with its core business. In 2001, HP merged with Compaq in a strategic move to bolster its presence in the competitive PC market. The merger faced opposition, but ultimately resulted in HP becoming one of the world's largest PC manufacturers.

By 2006, HP was the biggest PC manufacturer in the world, but cracks in its armour started to appear. The Silicon Valley giant’s biggest rival was Dell ($DELL). That began to change when the leading PC manufacturer in China, Lenovo, acquired IBM’s ($IBM) PC division. Lenovo used these new assets to leverage an international expansion into key markets, such as the U.S. and Europe, with an already established and trusted brand, the ThinkPad. The Chinese company would dethrone HP in 2013 and remains the leading PC manufacturer to this day.

While Lenovo successfully executed its growth strategy, HP also fell behind because its plans didn’t go as smoothly. In 2010, the company acquired the handheld computer manufacturer Palm for US$1.2b, hoping to capitalise on the rise of smartphones and tablet computers. However, HP ultimately decided to pull out of these areas after failing to gain any traction.

Palm wasn’t the only merger that went sour for HP. In 2011, it acquired the British data analytics company Autonomy. HP paid US$10.3b, a whopping 79% premium over the market price for its shares. In 2012, however, HP found severe accounting improprieties in Autonomy’s books, which eventually led to a write-off of US$8.8b.

Revamping

In October 2014, after multiple rounds of layoffs and restructuring attempts, the technology colossus announced it was going to split its operations. In November 2015, a division would occur between hardware production, named HP Inc ($HPQ), and technology services, named Hewlett Packard Enterprise ($HPE).

Interest in HP Inc’s shares have increased since legendary investor Warren Buffett acquired a 12.3% stake in it through his conglomerate, Berkshire Hathaway ($BRK.B), in April 2022. However, this optimism is yet to flow through to the company’s financial numbers. In Q2 2023, HP’s revenue was $12.91b, revealing a year-on-year drop of -21.7%. PCs were worst affected with a 29.1% fall in sales, whereas printing revenue fell only -4.6% over the same period.

Resilience in printing is fundamental to the company’s success. It accounted for 67% of HP’s operating profit (US$899m of US$1.3b), despite sales revenues being roughly half of computers (US$4.7b vs US$8.1b). Most of that printing profit comes from supplies, predominantly ink cartridges.

HP has struggled to achieve revenue growth since Q2 2021. Macroeconomic headwinds have certainly inflicted substantial damage to the company, especially with the rise of interest rates globally. However, their future prospects seem to be improving. The board expects earnings to grow between 1% and 13% in the next quarter, ranging from US$1.21b to US$1.35b, with major economies expected to stabilise after months of increased volatility. For now, Buffett stands at an unrealised loss of US$280m, but it might be too early to call HP a value trap.

This does not constitute financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Megan is a markets analyst at Stake, with 7 years of experience in the world of investing and a Master’s degree in Business and Economics from The University of Sydney Business School. Megan has extensive knowledge of the UK markets, working as an analyst at ARCH Emerging Markets - a UK investment advisory platform focused on private equity. Previously she also worked as an analyst at Australian robo advisor Stockspot, where she researched ASX listed equities and helped construct the company's portfolios.