Under the Spotlight: Broadcom Inc

Nvidia might be the face of AI, but Google’s decision to scale its own Broadcom-built chips signals a new kind of hardware arms race.

.jpg&w=3840&q=100)

ICYMI: Do your own research and make your own decisions. This article drills down on a specific company, however, it is not a recommendation to invest in the company and should not be taken as financial advice. Got a stock you want covered? Tell us here.

Broadcom Inc. ($AVGO) may lack the star power of Mag 7 stocks like Nvidia ($NVDA) or Apple ($AAPL), but it’s doing a convincing audition for Mag 8.

For decades, Broadcom has built the components that sit behind the industry’s biggest products. Most people wouldn’t recognise the name, yet Broadcom is now the sixth biggest company in the U.S., ahead of Meta ($META), Tesla ($TSLA) and Berkshire Hathaway ($BRK.A).

It tracks. Broadcom touches almost every part of the digital world. If you’ve streamed a movie, searched on Google or sent a message across the internet, there’s a good chance it travelled through Broadcom hardware. In fact, the company estimates 99% of global internet traffic touches at least one of its chips.

Now its role in the future of AI has pushed Broadcom front and center. A run of billion-dollar custom chip deals, including with OpenAI and a mystery bigshot buyer, has put Broadcom at the center of the AI race, sending its price soaring to new records.

This is where the story gets interesting.

Broadcom's AI push

Broadcom’s roots are in communication tech, not AI. But the skills translate, and the company hasn’t wasted time leaning into that advantage.

It’s paid off. In the last 12 months, $AVGO has jumped more than 120%, beating big movers like Nvidia, Tesla and even Alphabet ($GOOGL). And as with most of the S&P 500’s gains lately, it’s all about AI.

Broadcom already supplies the silicon and networking gear that keep data centres moving at scale. But the main story is its custom built chips, known as ASICs (Application-Specific Integrated Circuits).

Nvidia still dominates the AI GPU market, but Broadcom’s ASICs, custom designed for specific needs, are proving an attractive alternative.

.png&w=3840&q=100)

OpenAI cemented that in October. The ChatGPT parent agreed to buy 10 gigawatts of Broadcom-designed accelerators over the next four years – an order that could net Broadcom over US$100B in revenue, according to some analysts.

It only added fuel to speculation about another US$10B ‘mystery’ chip contract mentioned on Broadcom’s earnings calls – a hyperscaler yet to be revealed.

Then in November, news that Meta Platforms was in talks to buy Google’s Broadcom-built TPUs over Nvidia’s GPUs sent $AVGO shares soaring 11%, even as $NVDA shares came under mounting pressure. It prompted the normally unshakeable Nvidia to get passive aggressive on X.

The financial impact of these enormous deals is already showing. In Q3 F25, Broadcom’s AI revenue jumped 63% YOY to US$5.2B, with management guiding to US$6.2B in Q4. It’s a steep acceleration for a business barely on the AI radar two years ago.

Is Broadcom the new Nvidia?

It’s tempting to frame Broadcom as Nvidia’s newest rival, but the reality’s more nuanced.

Broadcom’s custom AI chips (XPUs) don’t aim to replace GPUs for every workload. Instead, they’re built for specific tasks like generating text, moving data and serving models. That tighter focus can make them faster, cheaper and more energy-efficient for certain jobs.

Nvidia’s edge is its software ecosystem and massive demand. Its GPUs are like the Swiss Army knife of AI compute – flexible enough for almost everything, from training to inference.

Broadcom’s moat comes from hyperscalers like Google and OpenAI, which want more control over their hardware and more predictable costs. Custom chips give them that.

But demand for AI chips isn’t slowing down. Nvidia can’t make GPUs fast enough. Rather than competing head-on, Broadcom gives big tech a different route: build your own AI stack instead of renting Nvidia’s. As each tech giant looks to differentiate its models, that option keeps gaining value.

A sprawling business empire

AI is the headline act, but Broadcom’s product list stretches far wider. Under the hood, it runs two massive segments. The first is semiconductors – everything from networking chips to radio-frequency components for smartphones to broadband and storage hardware.

The second is enterprise software, built through years of aggressive acquisitions. The biggest of these was cloud and virtual software firm VMware, bought for US$61 billion in 2023. It runs the private-cloud systems used by thousands of banks, telcos and large corporates.

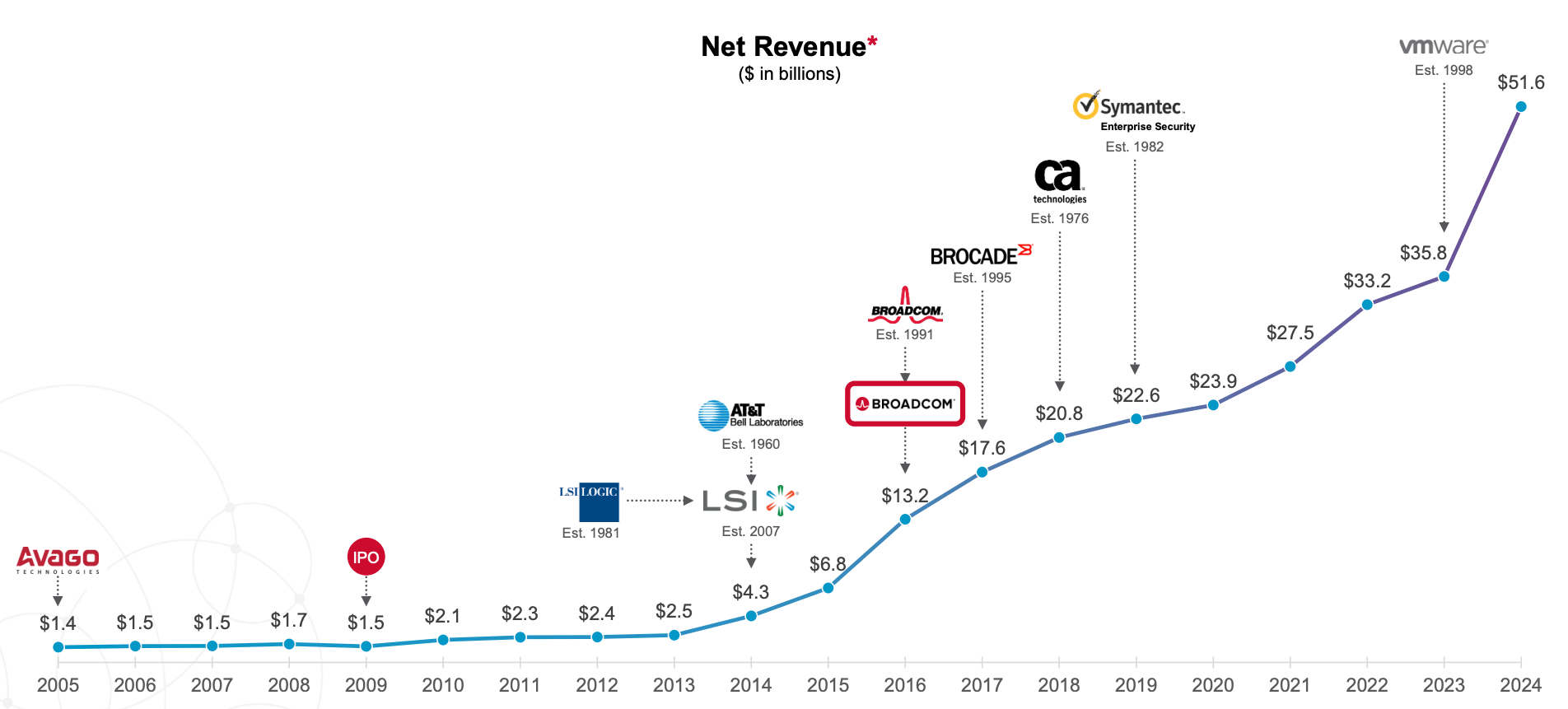

Source: Broadcom Inc

Together, these businesses have turned Broadcom into a heavyweight in both data-center hardware and software. Beyond custom AI chips, it dominates the market for Ethernet switches. Almost every data centre on earth runs on Ethernet, and more AI compute is shifting onto Ethernet fabrics too.

Financially, the business is in strong shape. In Q3 FY25:

Revenue rose 22% YOY to hit a record US$16B

GAAP net income swung from a US$1.9B loss to a $4.1B profit

Adjusted net income rose 37% to hit US$8.4B

Free cash flow jumped 47% to just over US$7B.

Adjusted earnings per share rose from US$1.24 to US$1.69

With the next earnings report due 11 December, management expects another record quarter, forecasting revenue of US$17.4B.

.png&w=3840&q=100)

Chipping away

Broadcom’s future growth depends partly on how quickly hyperscalers adopt custom chips.

The OpenAI partnership alone is expected to drive meaningful revenue for years. And analysts are broadly optimistic.

Morgan Stanley predicts Broadcom’s AI revenue growth will outpace Nvidia’s in 2026, guiding a price target of US$443 in December – a 16% lift from its current price at Wednesday’s close (Dec 3). Goldman Sachs went to US$435 in November while Barclays raised its target to US$450. Jefferies sits at the top of the range with US$480.

According to LSEG, 15 analysts rate the stock a strong buy, 32 say buy and 2 say hold. The average price target has climbed from US$332 at the start of September to about US$402 today.

Most upgrades point to the same thing: Broadcom has become a critical supplier in the AI hardware boom, and its software arm provides a steadier base than most semiconductor players.

Is $AVGO a buy?

Broadcom doesn’t fit neatly into a category. It’s not a pure AI play like Nvidia, and it’s not solely a software company like Oracle. It sits in between, and that mix has become a strength. AI is driving rapid growth on the semiconductor side, while VMware and the broader software business add predictable recurring revenue.

But Broadcom’s success is also increasingly tied to a handful of huge customers. Losing one would hurt. And with a share price that’s gained 64% so far this year – outpacing every Mag 7 stock – the question is how much further $AVGO can run. With a P/E ratio of 96 in December, it sits above the semiconductor sector average of 89, suggesting it may be overvalued.

But if you think AI infrastructure will keep expanding over the next decade, Broadcom sits right at the centre of it. The stock isn’t cheap, but the growth story is clear and the company keeps backing it up with results.

For long-term investors looking for exposure to AI without adding another GPU stock, Broadcom’s worth a closer look.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. The author of this article and other employees of Stakeshop Pty Ltd may hold positions or have financial interests in the company (or companies) discussed above. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

Kylie Purcell is an investments analyst and finance journalist with over a decade of experience covering global markets, investment products and digital assets. Her commentary has been featured in publications including the Australian Financial Review, Yahoo Finance and The Motley Fool. She has a Masters Degree in International Journalism from Cardiff University and a Certificate of Securities and Managed Investments (RG146).