.png&w=3840&q=100)

Under the Spotlight AUS: Betashares Australia 200 ETF (A200)

The Betashares Australia 200 ETF is up 19% since April, but earnings season will test the market’s record breaking rally.

.png&w=3840&q=100)

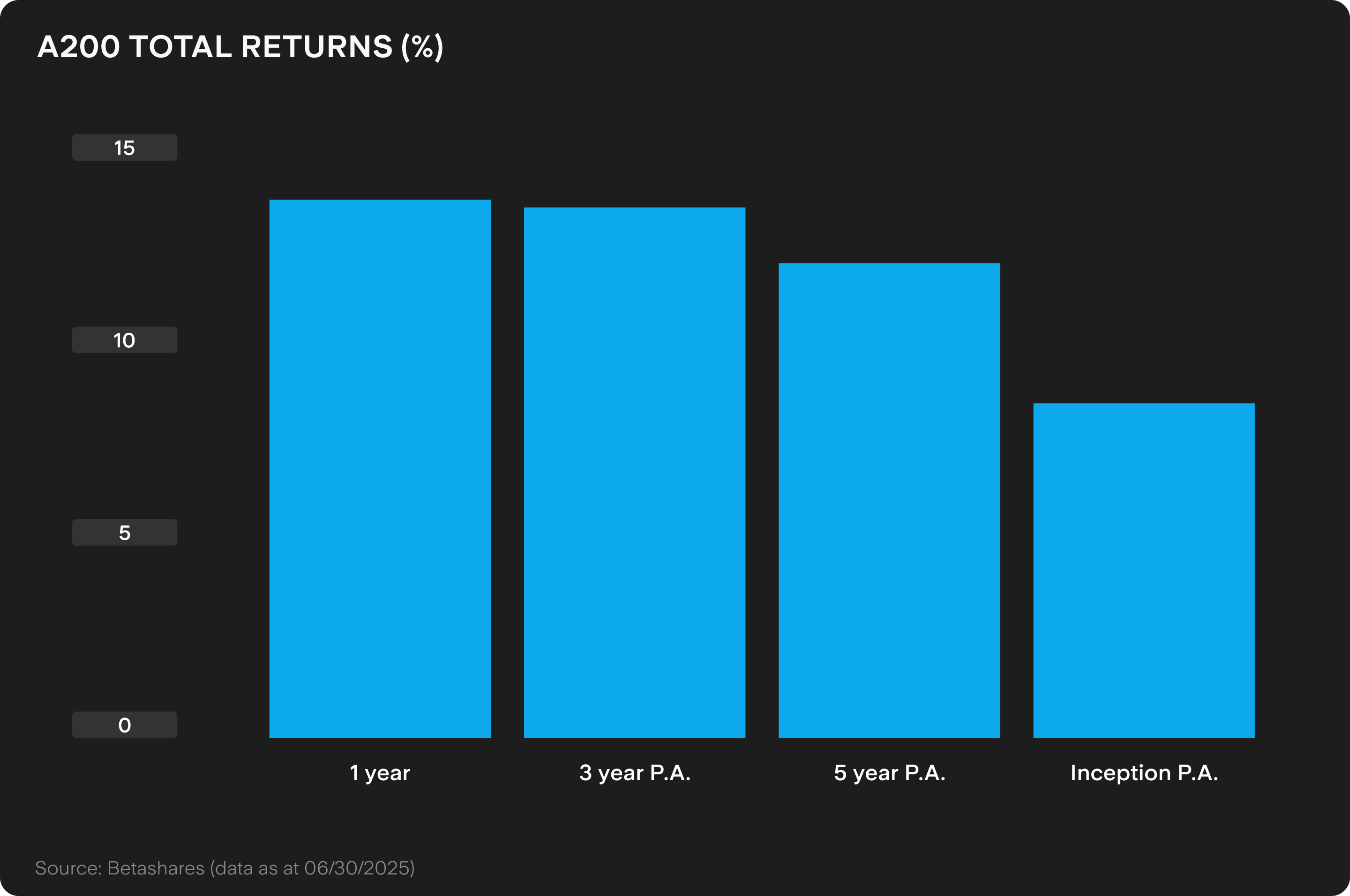

The Australian stock market has been on a record-breaking run, notching up a 19% gain since April as it tracks Wall Street’s rally fuelled by tech’s winning streak and easing trade tensions. And the Betashares Australia 200 ETF ($A200) is riding the wave.

But the rally in the benchmark S&P/ASX200 Index is set to be tested as ASX earnings season kicks off from 4 August. With Aussie companies set to deliver their full-year report cards and provide guidance on the outlook for earnings, it can be a time of heightened volatility as fund managers quickly punish companies that fall short of expectations.

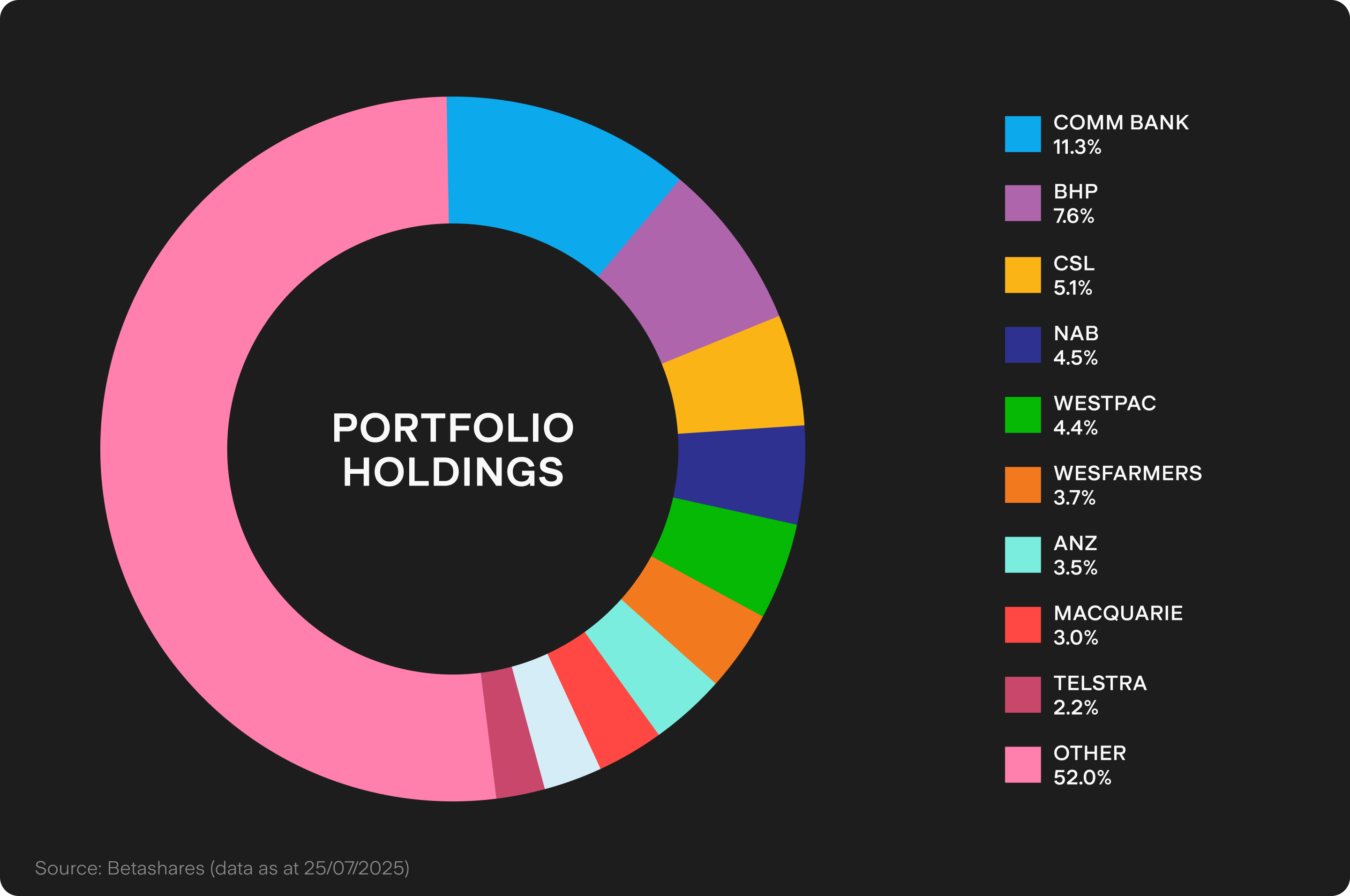

A200 is one way to take a position this earnings season. It tracks an index of the top 20 stocks and provides investors with low-cost access to blue chips like Commonwealth Bank ($CBA), BHP ($BHP) and CSL ($CSL), as well as faster growing companies like WiseTech ($WTC), Xero ($XRO) and Pro Medicus ($PME).

It’s an interesting season, to put it mildly. There’s uncertainty around global trade, China and the strength of the consumer. Investors will be watching forward guidance on FY26 earnings growth closely.

And this month is ASX investors’ favourite time of year: final dividends and any special dividends get declared.

Betashares claims A200 is the world’s lowest cost Australian shares index ETF, given an annual fee of just 0.04%. It pays quarterly and trades on a grossed-up yield of 4%. It tracks the Solactive Australia 200 Index and has net assets of $7.92b.

Numbers game

This earnings season is a tale of two markets: weak earnings from mining stocks, mixed growth elsewhere. Macquarie tips a 3% drop in FY25 earnings – the third straight year of lower earnings for Australian stocks. UBS forecasts a 1.7% drop in profits.

Weak iron ore prices have dented resources’ profit growth, with Macquarie expecting the sector earnings to fall 17.9% year-on-year (YOY). But Macquarie and UBS highlight that most sectors have downgraded earnings expectations since February’s half-year earnings season, while Macquarie expects industrials (excluding banks and REITs) to grow earnings 5.8% YoY.

The good news? Analysts see a return to earnings growth in FY26. But both UBS and Macquarie warn these forecasts could be pared back as companies update guidance.

UBS sees companies who have high exposure to Australia’s economy as the biggest risk to FY26 earnings. Macquarie warns that the forecast 2.4% rebound in FY26 earnings ‘looks weak’.

Buybacks and special dividends are also on the agenda. Treasury Wine Estates ($TWE) plans to buy back 5% of its shares. JB HiFi ($JBH) and Super Retail ($SUL) may dish out special dividends, according to Morgan Stanley. The broker also reckons Wesfarmers ($WES) could follow suit after the sale of its Coregas unit.

Big three

A200 might hold the ASX’s 200 biggest stocks, but three names dominate: Commonwealth Bank, BHP and CSL account for roughly 25% of its portfolio.

CBA is the biggest at 11.3%, after becoming the first Aussie company to crack a $300b market cap. The stock has benefited from ETF inflows and increased buying from foreign investors.

All eyes will be on CBA’s 13 August earnings to gauge if its ritzy multiple of 30x earnings and 4x book value is justified. Australia’s largest lender dominates the market, with one-in-three retail clients and one-in-four businesses using it as their main financial institution.

Net interest margins will be a focus as mortgage competition heats up. CBA, like all banks, is benefiting from a steeper yield curve.

Lower interest rates mean banks can fund themselves more cheaply through deposits, helping protect margins. CBA also claims to be cutting costs through greater use of AI.

The bank’s big three rivals – ANZ, NAB, and Westpac – all have 30 September year ends and deliver quarterly trading updates in August.

BHP (7.6% weighting) goes into reporting season on a high after record production in the June quarter.

Iron ore business and copper output hit highs in FY25, thanks to a 17-year high output from the world’s largest copper mine, Escondida. But its Jansen potash project is set to run over time and budget.

BHP is expected to deliver FY25 net profit of around US$10b – down from US$13.7b last year – when it reports on 19 August. Iron ore prices have been weak as China’s property market slump weighs on steel demand. Meanwhile, copper’s record high rally has been clipped after the U.S. imposed a 50% tariff this week.

While the outlook for iron ore and copper prices is key, analysts will be keen to hear if the miner is still willing to bulk up its copper business after a rejected offer for Anglo American.

Biotech giant CSL has been under pressure after the Trump administration placed the pharmaceutical industry in its crosshairs. The company has about 60% of its staff in the U.S. and produces a significant volume of vaccines and blood plasma products Stateside. The threat of a 200% tariff is a big concern, and investors will be scanning its earnings on 19 August for any tariff-related impacts.

CSL may also use its earnings report to update on plans to consolidate its R&D, which may involve job cuts. For now, the company maintains forecasts to grow earnings at a double digit rate over the medium term.

Tech stars

Reporting season also spotlights ASX’s tech highflyers WiseTech, Xero and Pro Medicus, who collectively have a market cap of over $100b.

WiseTech, which reports on 27 August, appointed Zubin Appoo as its new CEO this week after months of questions about its corporate governance. The company has flagged that revenue and EBITDA will be in the lower half of its guidance range and investors will be keen to hear about customer growth and the US$2.1b acquisition of e2open.

Xero updates investors on its US$2.5b acquisition of Melio. The deal provides greater exposure to small businesses in the U.S., though at the time the company hadn’t updated its FY26 operating expense to revenue forecast of 71.5%. Xero reports on 21 August.

Pro Medicus, which reports on 14 August, continues to win contracts for its medical imaging and software, with two new customers worth $190m secured this month alone. It recently became the second company – alongside Cochlear – with a share price above $300. Trading on a triple-digit PE, investors will want to see guidance highlighting ongoing momentum in contract wins.

Cheap as chips

A200 provides low cost access to Australia’s 200 largest stocks.

It’s performed well after a wobble in April, but the ASX earnings season will decide whether the record breaking run continues or if investors take a pause that refreshes.

ASX EARNINGS CALENDAR

11 Aug: JB Hi-Fi ($JBH), Beach Energy ($BPT) and Iress ($IRE)

13 Aug: Commonwealth Bank ($CBA), IAG ($IAG) and Treasury Wine ($TWE)

14 Aug: Telstra ($TLS), Suncorp ($SUN) and Pro Medicus ($PME)

18 Aug: BlueScope Steel ($BSL), Aurizon ($AZJ) and A2 Milk ($A2M)

20 Aug: Transurban ($TCL), Santos ($STO) and Breville ($BRG)

21 Aug: Xero ($XRO), Goodman ($GMG) and Northern Star ($NST)

25 Aug: Fortescue ($FMG), Reece ($REH) and Bendigo and Adelaide Bank ($BEN)

26 Aug: Coles ($COL), Aussie Broadband ($ABB) and Web Travel ($WEB)

27 Aug: Woolworths ($WOW), WiseTech ($WTC), Domino’s Pizza ($DMP)

28 Aug: Wesfarmers ($WES), Qantas ($QAN) and Mineral Resources ($MIN)

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.

.png&w=3840&q=100)

.png&w=3840&q=100)

.png&w=3840&q=100)