Critical

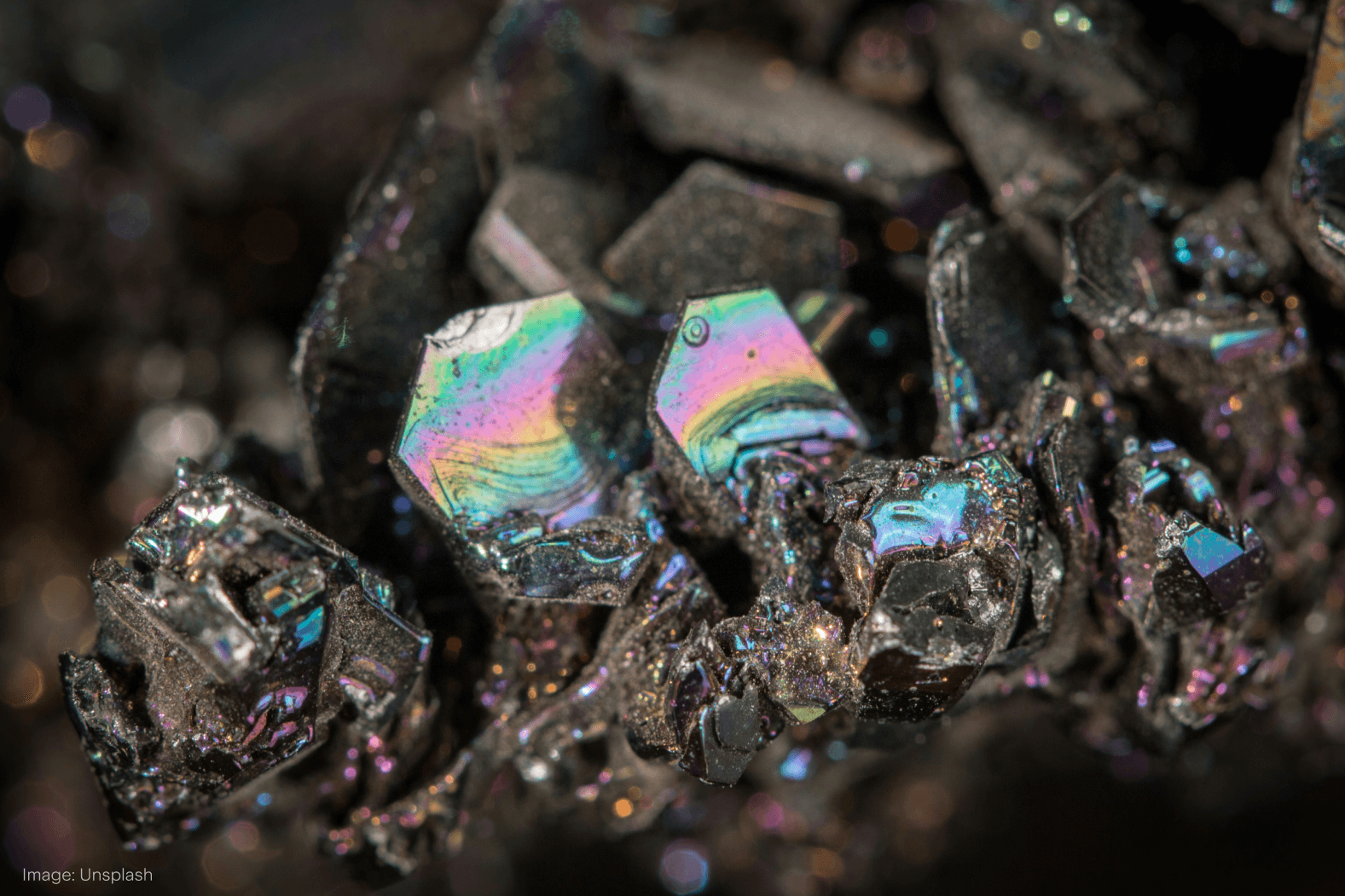

Tariff threats, panic, and a cooldown. As markets rebound, investors are zeroing in on one key area: critical minerals.

Last Friday was brutal. U.S. markets shed US$2.5T as Trump threatened 100% tariffs on Chinese imports after China said it would restrict rare earth exports. Crypto had it worse, with over US$19B in forced liquidations in one day – the largest in crypto history.

But by Monday? A different story. The S&P 500 posted its best day since May after Trump posted on Truth Social: ‘Don’t worry about China, it will all be fine.’ In true TACO fashion, retail investors bought the dip. On Stake, 74% of all Monday’s Wall Street trades were buys – the highest daily buy ratio in the last 12 months.

Oracle ($ORCL) rallied 5% after announcing partnerships with Zoom and Duality for cloud infrastructure and data collaboration. Broadcom ($AVGO) surged 9.8% after scoring a chip supply deal with – you guessed it – OpenAI.

JPMorgan ($JPM) gave U.S. tech another boost with plans to invest US$10B in companies aligned with strategic government interests, including quantum computing. That sent IONQ ($IONQ) and Rigetti Computing ($RGTI) flying higher.

But the biggest winners? Rare earth stocks. The largest American rare earths miner, MP Materials ($MP), soared 21%. Meanwhile, Critical Metals ($CRML) soared 55% in Monday's session, and a further 21% after-hours on reports the U.S. government might take a US$50M stake to secure Greenland’s Tanbreez rare-earth deposit.

Closer to home, Arafura Resources ($ARU) has rallied 36% since Friday. Lynas Rare Earths ($LYC) also reaped the rewards – it’s currently the largest producer and processor of rare earths outside China.

Why the surge? Rare earths power everything from EV motors to missiles. And right now, China controls over 80% of global refining capacity. Any threat to that supply chain sends shockwaves across diverse sectors, including defence, clean energy and AI.

The price action suggests it might be more than a short-term trade. Investors are betting on a long-term structural trend – one that’s not just critical for minerals.

This is not financial advice nor a recommendation to invest in the securities listed. The information presented is intended to be of a factual nature only. Past performance is not a reliable indicator of future performance. As always, do your own research and consider seeking financial, legal and taxation advice before investing.